carried interest tax loophole

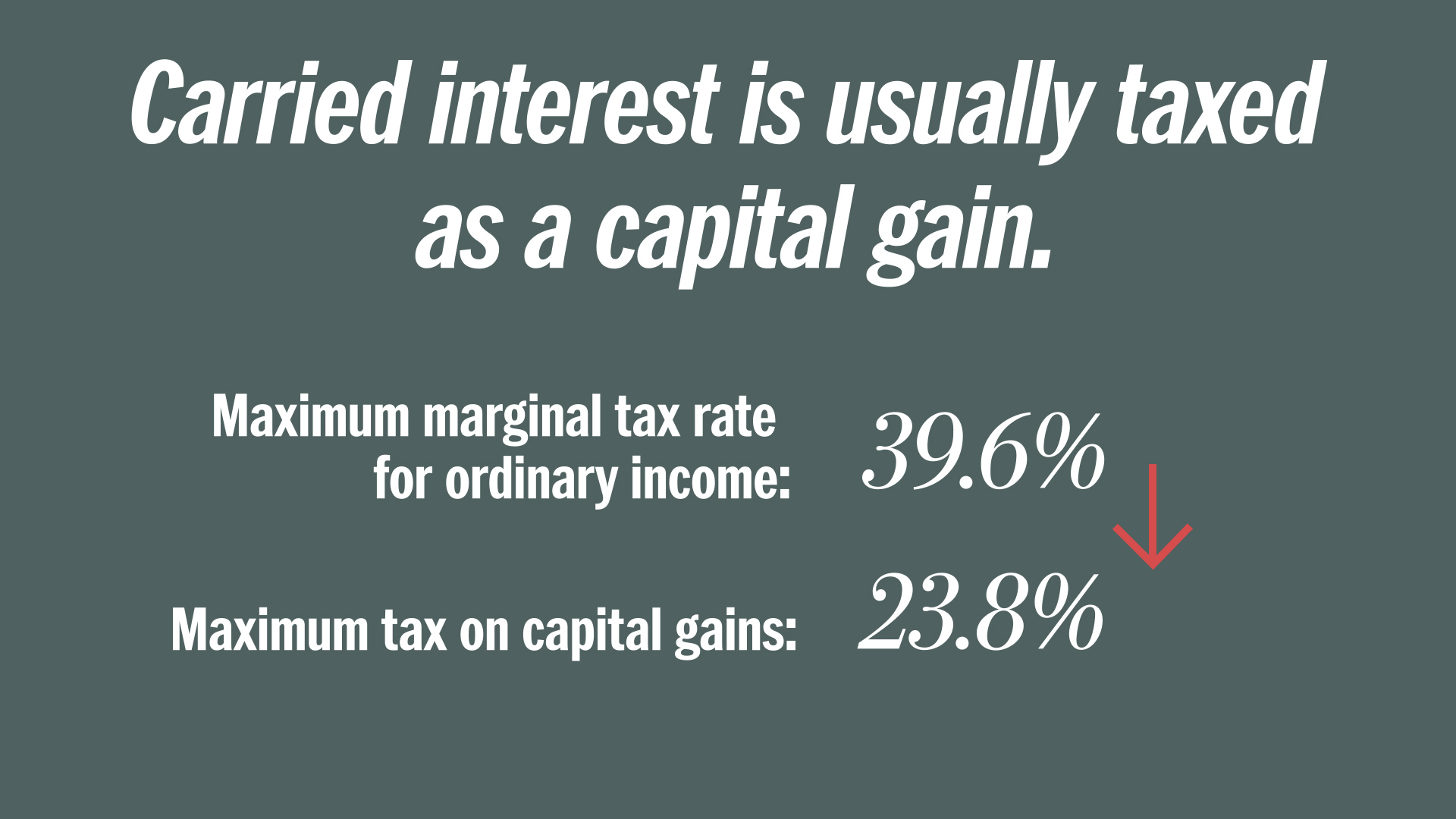

This allows wealthy private equity real estate and hedge fund managers to claim the fees they receive for their services as capital gains which are taxed at a rate of just 238 percent instead of the top marginal income tax rate of 37 percent. 14 2018 1144 am ET.

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Partnership profits interest for services A profits interest in a partnership is the right to receive future profits in the partnership but does not generally include any right to receive money or other property upon the immediate liquidation of the partnership.

. Because its not classified as ordinary income general partners have to pay far less tax than they normally would. Ron Wyden D-OR and Sheldon Whitehouse D-RI introduced the Ending the Carried Interest Loophole Act the Bill. They see it as a tax loophole that benefits the rich.

This creates a controversy that carried interest is a tax loophole. Critics argue that this is a tax loophole since portfolio managers get paid from that money which is not taxed as income. Carried interest is a share of a private equity or funds profits that serve as compensation for fund managers.

Ending the Carried Interest Loophole Act. Tax CodePoliticians from both parties often view carried interest as a tax loophole. Carried interest refers to a longstanding Wall Street tax break that let many private equity and hedge fund financiers pay the lower capital gains tax rate on much of their income instead of the higher income tax rate paid by wage-earners.

WASHINGTONTreasury Secretary Steven Mnuchin said the government will act within two weeks to block a hedge-fund maneuver around part of the new tax law. What is carried interest loophole. Managers of various types of investment funds that are structured as partnerships often receive a profits interest in the fund commonly referred to as a carried interest in exchange for their services.

One of the most extreme examples of tax privilege is the so-called carried interest loophole. The carried interest loophole allows fund managers to benefit from profits made by putting other peoples money at risk as if it were their own. Absent the carried interest loophole high earning investment managers would otherwise pay up to a 396 tax rate.

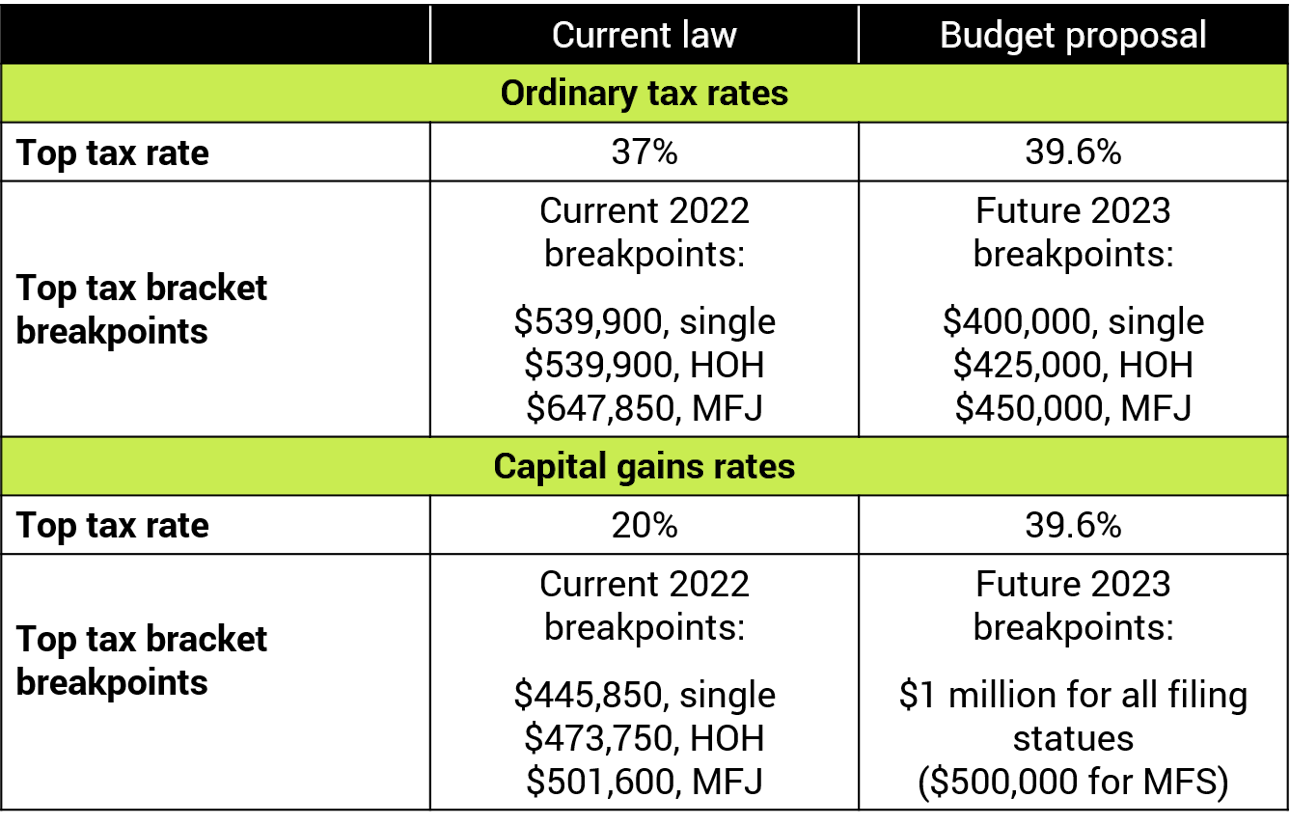

The Carried Interest Fairness Act would clarify that this income be subject to ordinary income tax rates rather than the lower capital gains rate. The so-called carried interest loophole allows Wall Street firms like private equity and hedge funds to pay the lower capital gains rate on their income 15 or 20 rather than paying ordinary income tax rates up to 37. The lawmakers provided this example.

All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. Or the Proposal aimed. The proposed Ending the Carried Interest Loophole Act S.

Doctors school teachers and police officers all other service providers pay ordinary tax rates on their labor income the salary of hedge fund managers gets special tax treatment a grossly unfair loophole that costs. During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest. The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph.

This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax. The tax code is broken and this is a primary example of why we need to fix it.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Treasury to close carried interest loophole in new tax law. In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000.

Carried interest is often the subject of political controversy because many believe it represents income that receives preferential treatment under the US. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. Carried interest allows hedge funds to evade their tax obligations.

Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate.

In this light the Tax Cuts and Jobs Act of 2017 increased the minimum holding period of an investment from one year to three years for the associated carried interest to be treated.

Carried Interest Loophole Take On Wall Street

What Is The Carried Interest Tax Loophole

How Private Equity Conquered The Tax Code The New York Times

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

How To Tax Capital Without Hurting Investment The Economist

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Tax Advantages For Donor Advised Funds Nptrust

Carried Interest In Private Equity Calculations Top Examples Accounting

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

How Private Equity Conquered The Tax Code The New York Times